2 Additional properties bought for less than 40000 will be charged the main residence rate of stamp duty. 0 on the first 125000 0.

PETALING JAYA Jan 31.

. Stevenage Office- 01438 748007 Knebworth Office-01438 817731 Hatfield Office -01707270777. Compute the stamp duty payable including Sellers Stamp Duty for the following types of documents. It takes into account the.

Stamp duty calculations for moving home additional property purchases and first time buyers. Be an informed homebuyer and use. The SDLT you owe will be calculated as follows.

Stamp Duty Calculator 2019 - 2020 Stamp Duty Calculator 2019 - 2020. Stamp duty calculator with instant stamp duty calculations. Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

The stamp duties on property sales and purchase agreements SPA for properties priced up to RM1 million and for loan agreements of up to. 3 The 300000 first. 1 Rate applies to that portion of the purchase price.

Purchase Print us. 2 on the next 125000 2500. 2 on the next.

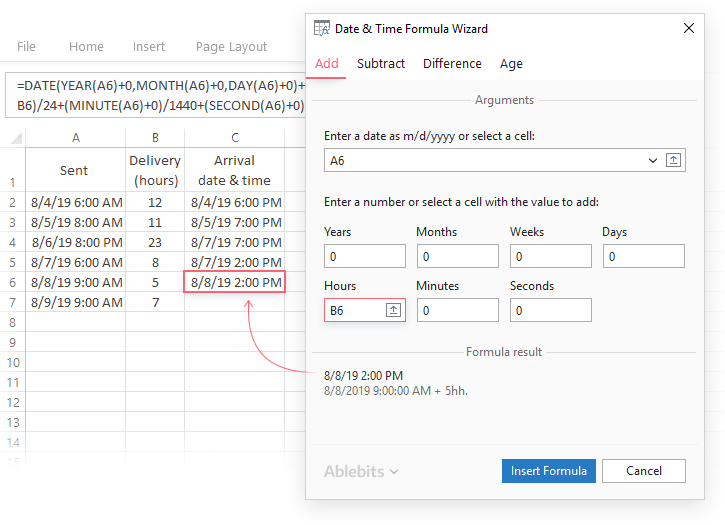

This calculator works out the land transfer duty previously stamp duty that applies when you buy a Victorian property based on. This publication is available at httpswwwgovuk. The date of the contract for your property.

0 on the first 125000 0. The Stamp Duty is charged on all property transactions in India ranging from 3 percent to 7 percent. So for example if you buy a house for 275000 the SDLT you owe is.

Ad Stamps and Shipping Labels for All USPS Mail Classes Available Online. The Stamp Duty Calculator is our easy-to-use tool that can tell you how much stamp duty youll need to pay from just a few simple questions. 187 plus 150 for every 100 or part by which the dutiable.

Ad Discover How to Print postage 24 hours a Day 7 days a Week. 125 for every 100 or part of the dutiable value. Ad Stamps and Shipping Labels for All USPS Mail Classes Available Online.

The loan agreement Stamp Duty is 050 from the loan amount. Liability limited by a scheme approved under Professional Standards. The additional property rates apply where after the purchase of a residential property for 40000 or more it.

If the loan amount is RM300000 the stamp duty for the loan agreement is RM300000 x 050 RM1500. The remaining amount. 4 min read Updated.

Postage from Home or Office. In October 2021 you buy a house for 295000. Enter the price location and purpose of the property youre buying and our stamp duty calculator will tell you how much tax youll have to pay on it.

Determine when your business is liable for GST registration. The portion above 15 million 12. Stamp duty is the tax youre required to pay.

5 on the final 45000.

Stamp Duty Victoria Vic Stamp Duty Calculator

Stamp Duty In Maharashtra 2021 Women Buyers To Get 1 Concession

Seller S Stamp Duty Of Up To 12 What Property Sellers Need To Know

Stamp Duty Property Registration Charges In Mumbai Aug 2022

Stamp Duty Law Cayman Islands Government

.webp)

Proteger Maton Vadear Commercial Stamp Duty Calculator Roto Sui Veinte

How To Calculate Tenancy Agreement Stamping Fee

Stamp Duty Valuation And Property Management Department Portal

Calculate Time In Excel Time Difference Add Subtract And Sum Times

Stamp Duty In Maharashtra 2021 Women Buyers To Get 1 Concession

Stamp Duty In Rajasthan Stamp Duty And Registration Charges In Rajasthan